The workers enjoyed the lesson while starting to think carefully about what he was showing – managing their monthly salary.

In a classroom of more than 20 garment workers, Vorn Navin wore his “peer educator” t-shirt committing to duty beside his position in the factory’s Stock department. As part of the collaboration with CARE Cambodia, the partner factories appointed their potential focal persons to join the project as peer educator and receive technical training provided by CARE.

Back at his factory, Navin was selected to join the project adding on to his usual duty. As he introduced himself with a friendly smile, He said “The head of the factory’s human resources selected me as a trainer when the factory first started the project with CARE Cambodia, and I got selected to join the Training of the Trainer and since then I worked with my team to further provide the training inside the factory.”

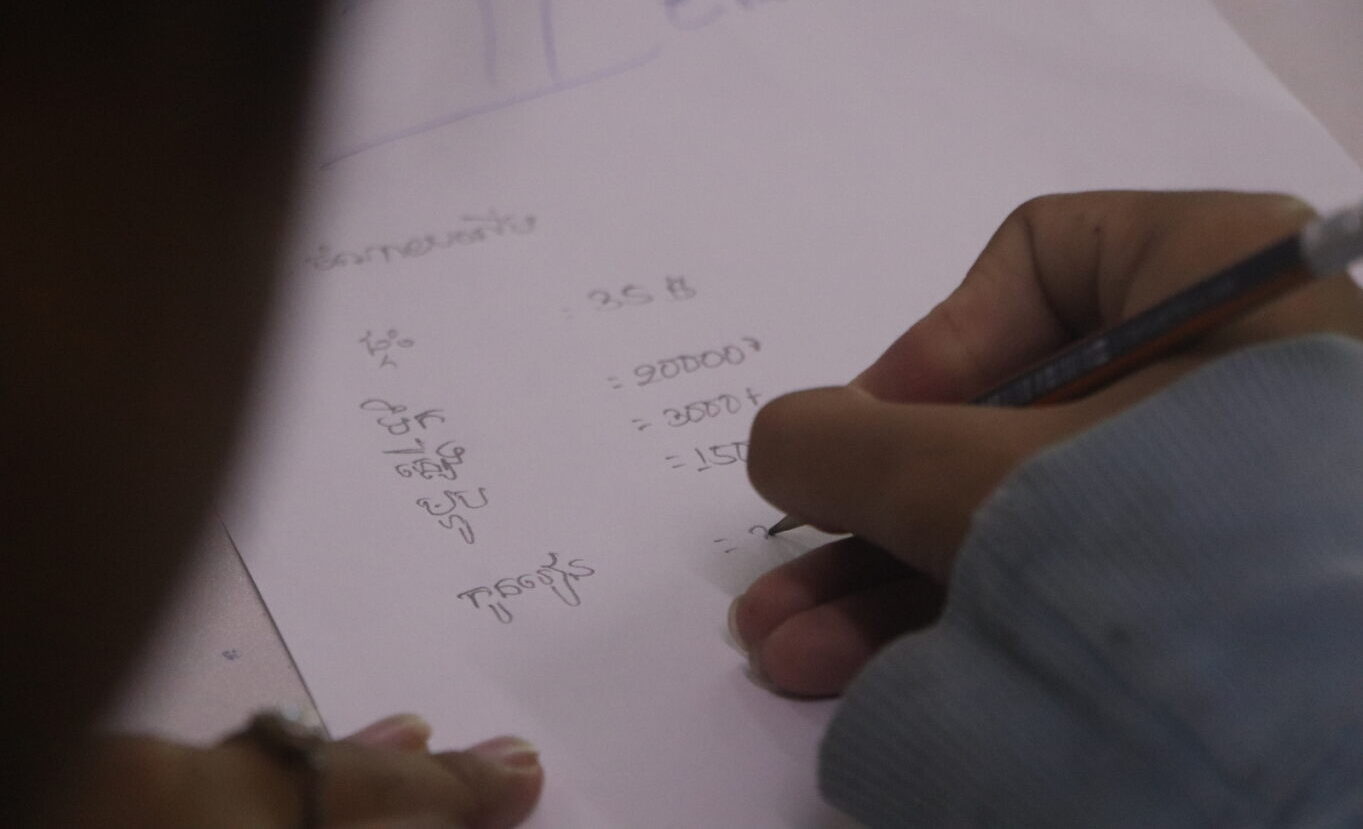

For someone with an outspoken personality like Navin, there is no doubt the reason behind his potential as a peer educator. Out of the three main sessions, he taught financial literacy by starting with small group work on categorizing incomes and spending of the worker’s monthly salary before continuing to his core lesson on the importance of categorizing and managing their income. “Follow what we are observed, we admit that even though workers have access to smartphone tools such as social media, Facebook or television to check information, most of the time they use those resources for casual entertainment like watching drama or scrolling around,” he said during a post-training discussion with CARE’s team.

Navin mentioned the benefit of selecting peer educators among the factory staff. “If the factory provides training like nowadays, workers will get direct knowledge and understanding. Our educators work with them in the same place, we all know each other so they [workers] have no fear joining or receiving the lesson.’’

Years of working in this industry, he witnessed challenges and concerns among the workers. Navin taught his students to create a financial book and note down spending every month as he pointed out the difference between need and want. His dedication followed the need to help garment workers better manage their financial risk and reduce the debt trap. When talking about behavior changes, Navin notices two main things.

“I see two tangible changes. First, workers started owning and using finance books and second, they reduced debt as they started to save and manage salary better. We notice a lot of reduction in money borrowing among them.” Creating a fun atmosphere is perhaps his skill. In another session, Navin did a mini role-play for his students when his teaching partner started her lesson.